Rome, 11 March 2025 17:29 Inside Information

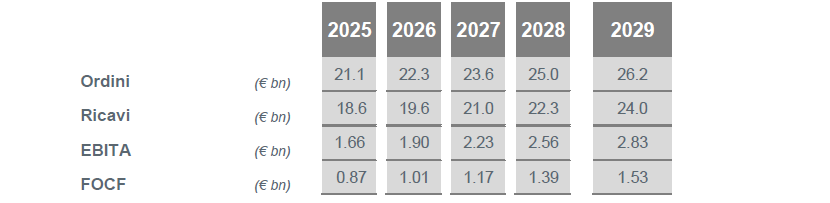

The evolution of financial KPIs forecasts, by 2029 (including the upside from new initiatives), orders at €26.2 billion (compared to €20.9 billion in 2024); revenues at €24 billion (compared to €17.8 billion in 2024); EBITA at €2.8 billion (compared to €1.5 billion in 2024); and FOCF at €1.53 billion (compared to €0.83 billion in 2024).

In the period 2025-2029, cumulative orders are expected to reach €118 billion (CAGR 2023-2029 +5.8%); cumulative revenues are expected to reach €106 billion (CAGR 2023-2029 +7%).

In the period, EBITA is expected to grow with a CAGR of 13.1% from 2023 to 2029; FOCF is expected to grow with a CAGR of 15.2% from 2023 to 2029.

A strong push towards the development of multidomain-interoperability technologies enabled by the digital continuum.

International alliances will be a key element in accelerating Leonardo's competitiveness in global markets (inorganic growth), complementing efforts to rationalize the product portfolio, streamline operations, and drive digitalization (organic growth).

A major STEM recruitment campaign will support technological development and the company’s long-term competitiveness.

Disciplined capital allocation strategy to support growth and shareholder returns.

Proposed dividend of € 0.52 per share in 2025 (€ 0.28 in 2024).

----------------------------------------------------

The Board of Directors of Leonardo, under the chairmanship of Stefano Pontecorvo, unanimously approved the update of the Industrial Plan for the period 2025-2029.

Leonardo presents today to the financial community the update of the Industrial Plan for 2029, announced in March 2024, including medium-term targets.

The advancement of the Industrial Plan, which aims to develop the next generation of technologies for global security, is based on the massive digitalization and rationalization of products and services, efficiency initiatives, and cost reduction at the Group level – a gross saving of €1.8 billion over the course of the plan, of which €191 million have already been achieved in 2024. The alliances developed with other defense players are seen as a key factor in accelerating the competitiveness and profitability of the group in the current landscape.

"The Industrial Plan launched 12 months ago," says Roberto Cingolani, CEO and General Manager, "is allowing Leonardo to play a leading role in the current international competitive landscape."

"The massive digitalization and rationalization of products and services, along with efficiency initiatives and cost reductions at the Group level," he adds, "have unlocked the organic growth potential of the business beyond expectations, leading the company to achieve strong growth in the top line right from the start, with all KPIs exceeding expectations."

"The start of the alliances and international partnerships undertaken in recent months," concludes Roberto Cingolani, "is the element enabling us to accelerate our development, completing our industrial and technological capabilities. This type of inorganic growth is proving to be a key factor for global competitiveness, especially in light of the recent evolution of the international geopolitical context. No one – whether state or company – can develop the multidomain and interoperable technologies necessary to ensure the security of their citizens while preserving the right to peace, a societal achievement that is currently being questioned. In the coming years, it will be increasingly crucial to have significant innovative capabilities in terms of R&D, production, and human resources to preserve the development of the company, but above all, of society."

UPDATE ON THE INDUSTRIAL PLAN: STRENGTHENING THE CORE BUSINESS AND PAVING THE WAY FOR LEONARDO'S FUTURE

Leonardo’s goal of leading the transition towards the development of interoperable multidomain technologies for global security, updating the concept of traditional defense in line with the current technological evolution driven by the rise of digital technologies, will be pursued by further strengthening organic growth, initiated in 2024, and developing all inorganic growth activities, starting with alliances and international projects.

The most significant actions for reinforcing the core business (portfolio rationalization, digitalization, efficiency improvements) include advancing the digitalization process, continuing the efficiency plan, and seeking new strategic partnerships in the aerostructures sector.

Digitalization will impact both internal processes and the development of new products and services to expand Leonardo’s portfolio. Internally, the main focus will be on production, with optimization and efficiency solutions, advanced product lifecycle management, and a shared cloud for planning. The development of the Digital Twin to optimize the entire product lifecycle, utilizing advanced AI systems and simulation, represents the most innovative phase in the manufacturing sector.

Regarding the reinforcement of its solutions, interoperability stands out in the development of systems in the context of GCAP (Global Combat Air Programme) like ISANKE (Integrated Sensing and Non-Kinetic Effects) and ICS (Integrated Communication System), which are the most advanced forms of digital continuity in the aeronautical sector. The AI Dynamic Cross Domain Command and Control encompasses digital capabilities to achieve full multidomain interoperability. Additionally, the development of custom digital services for post-sales support will further enhance the offering.

During the first 12 months, the acceleration of the efficiency plan resulted in savings of €191 million, compared to the €150 million originally forecasted for March 2024. The target remains confirmed at €1.8 billion within the Plan’s time horizon.

Creating a global player in the Aerostructures sector, capable of competing in the new post-COVID competitive landscape, involves seeking a new alliance to support a solid and sustainable long-term business. The ambition is to become a reference partner for OEM (Original Equipment Manufacturer) operators, expanding business into new markets.

The future of Leonardo, focused on creating new interoperable multidomain technologies that form the basis of global security, aims to consolidate and further accelerate both its capabilities and alliances, while developing potential ones. The progress made in the first 12 months is particularly promising.

The most representative initiatives are:

- The New Space Division of Leonardo, which aims to centralize all initiatives within the group and offer E2E (end-to-end) solutions. In a global space market expected to grow by approximately 7% annually until 2030, the Space Division will seize new opportunities created by advanced data analysis systems and emerging military and governmental needs (intelligence). This also marks a new phase within the Space Alliance. The data constellation configuration resulting from this review, along with the development of new data valorization models, will generate an estimated revenue growth of €1.3 billion over the plan period.

- Leonardo Rheinmetall Military Vehicles, the joint venture, established to develop the most advanced and next-generation technologies related to the multi-domain MBT (Main Battle Tanks) derived from the Panther platform and the AICS, Armoured Infantry Combat Systems derived from the Lynx platform. The program is expected to generate an estimated upside of approximately €1 billion over the course of the plan, for the production of 1,050 AICS units and 272 MBT units by 2040, considering only the contract for the Italian army.

- Leonardo-Baykar JV in the UAV (Unmanned Aerial Vehicles) sector, which aims to create a global player in this promising and rapidly growing segment. The partnership will leverage Baykar’s advanced unmanned platforms, which have demonstrated operational effectiveness in international markets, and Leonardo’s expertise in mission systems, payload design, and aviation certification in Europe. Both companies, currently involved in the development and production of UAV systems, electronic systems, payloads, C4I (Command, Control, Communications, Computers, and Intelligence), artificial intelligence, integrated mission systems, and space equipment and services, will ensure interoperability within multidomain ecosystems. The program is expected to generate an estimated upside of €600 million over the plan period.

- GCAP for the development of the next generation of fighters, together with JAIEC and BAE Systems, with the possibility of evaluating the inclusion of new partners to accelerate the development of the program. Leonardo brings its capabilities in electronics and digitalization to the program, particularly in the area of combat systems (EW / Radar multi-mission systems and multi-sensor & multi-spectral data fusion).

- The new Leonardo Hypercomputing Continuum (LHyC) Line of Business, established to develop the full potential of digital technologies, AI, and HPC to improve Leonardo’s entire value chain, from engineering simulation to generative AI predictive systems, to satellite image analysis. The market potential for these solutions spans from AD&S to energy, healthcare, transportation, financial services, and public administrations. The program is expected to generate an estimated upside of cumulative orders equal to €230 million over the plan period.

These initiatives are expected to contribute significantly to Leonardo’s growth, with cumulative orders projected at €5.4 billion and cumulative revenues at €3.1 billion over the plan period.

The revenue growth trajectory, forecast to reach €24 billion by 2029 - including the upside from new initiatives - will be driven by increased capacity in delivering the products and solutions developed by Leonardo. A dedicated program will be launched to reach full potential capacity and improve profitability within the Industrial Plan timeframe. The goal of the Capacity Boost program is to address the so-called “new normal,” characterized by the shift from the concept of Defense to Global Security – requiring Governments to strengthen critical infrastructures using innovative technologies – in a dual-use perspective.

On the human capital front, Leonardo aims to attract talent in the key competencies of the future, such as quantum technologies, Digital Twin, High-Performance Computing, and AI, to master emerging technological trends. Specific recruitment plans will focus on bringing in System and Software Engineers to support the growth of the Space sector, resources with engineering and project management skills to develop the GCAP program, and the digital innovation team will be strengthened with specialists to accelerate the growth of the Cyber sector. Leonardo’s talent development plan includes the launch of flexible training programs - focused on management approaches and soft skills - to address an increasingly complex market environment. In particular, AI-based learning tools and platforms will be introduced to support skill alignment, with the creation of personalized development paths.

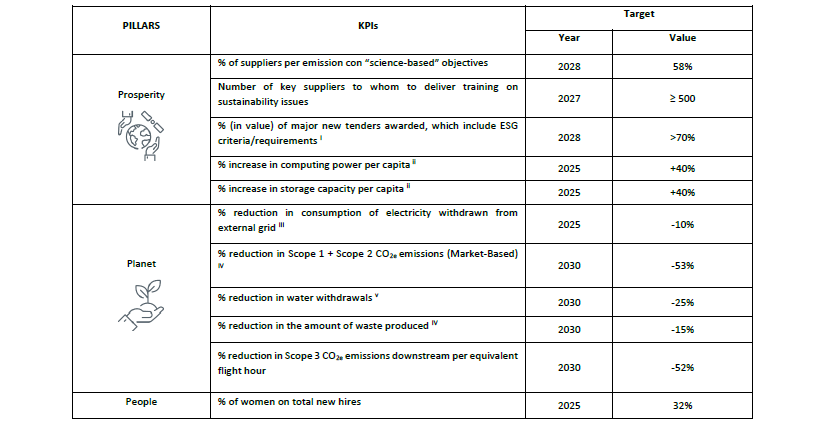

UPDATE OF THE SUSTAINABILITY PLAN 2025-2029: STRENGTHENING BUSINESS COMPETITIVENESS

The 2025-2029 Sustainability Plan, integrated into the 2025-2029 Industrial Plan, covers Leonardo’s entire value chain and focuses on high-impact projects for the business, with an estimated capex and opex value of approximately €280 million over the Plan's horizon. More than 50% of this budget covers the development of sustainable products and solutions, with a growing contribution from the Space and Cyber businesses. Leonardo aims at developing digital technologies for global security of citizens and infrastructures, as well as climate protection, with examples including global monitoring, advanced virtual training systems for helicopters and aircraft, and the use of new sustainable fuels (SAF). The projects of the Sustainability Plan are selected to achieve also the Group’s objectives, based on Prosperity, Planet, People, and Governance pillars, with a focus on: strengthening the responsible management of the entire supply chain, with the inclusion of the ESG criteria in major new procurement tenders; enhancing digitalization with increased computing power per capita; confirming the decarbonization roadmap with targets validated by the Science-Based Targets Initiative, which also include upstream and downstream Scope 3 emissions; continuing efforts to reduce the Group's environmental impact, particularly in terms of water consumption, waste production, and promoting circularity, particularly regarding critical raw materials; promoting STEM skills and fostering a culture that nurtures diversity, equity, and inclusion with a view to strengthening female presence and contribution, both as new hires and in leadership positions. Moreover, the projects of the Plan strongly contribute to reinforcing Leonardo’s leadership position in the AD&S sector among the key ESG ratings and sustainability indices internationally acknowledged.

Sustainability goals of Leonardo’s Group

I Calculated on tenders valued >1M€ managed through LDO portal. It does not include DRS, the Electronics Division of LDO UK and local purchases on the part of foreign subsidiaries.

II Calculated as the number of flops and bytes in relation to employees in Italy

III Reduction calculated as a ratio to revenues

IV Reduction in absolute value.

V Reduction in absolute value in water withdrawals from aqueducts and wells.

DIVISIONS HIGHLIGHTS

The Plan will focus on the capabilities of each business segment. For the Divisions, Leonardo’s goal is to strengthen the core business and pave the way for the broader challenge of global security.

Electronics: Become a global player in Defense Electronics by increasing competitiveness, investing in technology, streamlining the product portfolio by focusing on core offerings, and leveraging international partnerships. Over the course of the Plan, the Electronics Division expects growth in orders, revenues, and EBITA of 6%, 8.5%, and 13%, respectively.

Helicopters: Strengthen the position as a global player in the civil sector and become a key player in the military sector by increasing the conversion of orders into revenues and boosting product development to reach a leadership position in tilt-rotor technology, considered the most viable and mature by leading military institutions. Over the course of the Plan, the Helicopters Division expects growth in orders, revenues, and EBITA of 3%, 6%, and 7.4%, respectively.

Aircraft: Ensure a leading role in major international cooperation programs, sustain high profitability, and increase competitiveness through the update of the product portfolio. Over the course of the Plan, the Aircraft Division expects growth in orders, revenues, and EBITA of 12%, 8%, and 4%, respectively.

Aerostructures: Overall challenging business context due to prolonged gap between workload and industrial capacity, compounded by high inflationary pressure. Developed and launched new industrial plan including multiple improvement levers such as business diversification, revision of make / buy policy, enhancement of industrial efficiency and supply chain restructuring. Over the course of the Plan, the Aerostructures Division expects growth in orders and revenues of 15% and 16%, respectively, with EBITA breakeven expected by the end of 2028.

Cyber: Capitalize on the accelerating demand to increase size through both organic and inorganic growth, acquiring distinctive technologies with the aim of becoming a key European player. Over the course of the Plan, the Cyber Division expects growth in orders, revenues, and EBITA of 14%, 15%, and 30%, respectively.

Space: Consolidate activities in a new Division and leverage existing capabilities to become a European leader in high-value-added segments, following an organic growth path to be integrated with inorganic levers. Over the course of the Plan, the Space Division expects growth in orders, revenues, and EBITA of 9%, 10%, and 13%, respectively.

FINANCIAL HIGHLIGHTS

The key objectives of the Industrial Plan for the next 5 years (2025-2029), including upside from new initiative (LRMV, Space, Leonardo Hypercomputing Continuum LoB, JV with Baykar). are:

Based on the current assessments of the impacts of the geopolitical situation also on supply chain, inflationary levels and the global economy, subject to any further significant effects

ORDERS

- Total orders amounting to €118 billion.

- Order growth driven by the product and solution portfolio that addresses evolving customer needs and new initiatives (Space Division, V, new Leonardo Data Centric Solution business line, LRMV JV, JV with Baykar).

- Favorable market conditions supporting both domestic and export order growth. No specific concentration on a single country/customer.

- Book-to-bill ratio significantly greater than 1, with the order backlog growing from €44.2 billion in 2024 to €56.8 billion by the end of the Plan.

REVENUE

- Estimated CAGR of 7% driven by the execution of the order backlog and new orders.

- Balanced growth across businesses with synergistic effects between platforms and sensors/systems operating in a multi-domain context.

- Proven track record in ensuring growth by successfully managing exogenous challenges in the supply chain.

EBITA

- Profitability growing at twice the rate of revenue growth.

- Operating leverage, strict program management, and Group-level efficiency plan supporting constant profitability growth throughout the Plan.

- Advanced technological offering and portfolio refocusing leading to increased project profitability.

- Contribution from new initiatives starting in 2026.

FOCF

- Doubling of FOCF thanks to EBITA growth, while investing in key growth programs and new technologies, accelerating investments in digital capabilities.

- Significant increase in taxes starting from 2027, due to the use of available past losses until 2026.

- Investments include both the upgrade of existing technologies and capabilities, as well as the boost from new initiatives.

CAPITAL ALLOCATION

The Group is implementing a disciplined capital allocation strategy to support growth and shareholder returns:

1. Investment initiatives to support organic growth, strengthen the core business, and pave the way for Leonardo's future.

2. Inorganic growth opportunities, focused on strategic growth areas.

3. Substantial increase in the dividend of 90% in 2025 with growth in shareholder returns over the course of the Plan.

4. Reduction of debt with a commitment to maintain Investment Grade status by the credit rating agencies.

DIVIDEND PROPOSAL

The Board of Directors of Leonardo has resolved to propose to the Shareholders' Meeting the distribution of a dividend of € 0.52 per share, based on the 2024 fiscal year’s profits, before any applicable statutory withholding taxes. The dividend will be paid starting from June 25, 2025, with the "ex-dividend" date (coupon no. 15) on June 23, 2025, and the "record date" (the date for determining eligibility to receive the dividend, according to article 83-terdecies of the TUF) on June 24, 2025. This applies to each ordinary share outstanding on the ex-dividend date, excluding treasury shares held at that time, except for those that will be effectively allocated under current incentive plans in the ongoing fiscal year.

WEBCAST DETAILS

Leonardo will present its Industrial Plan today at 5:30 pm CET via webcast.

Webcast details are available on Leonardo’s website, section Investor Relations (https://www.leonardo.com/en/investors/results-and-reports) where the presentation can also be downloaded.

SAFE HARBOR STATEMENT

Some of the statements included in this document are not historical facts but rather statements of future expectations, also related to future economic and financial performance, to be considered forward-looking statements. These forward-looking statements are based on Company’s views and assumptions as of the date of the statements and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Given these uncertainties, you should not rely on forward-looking statements.

The following factors could affect our forward-looking statements: the ability to obtain or the timing of obtaining future government awards; the availability of government funding and customer requirements both domestically and internationally; changes in government or customer priorities due to programme reviews or revisions to strategic objectives (including changes in priorities to respond to terrorist threats or to improve homeland security); difficulties in developing and producing operationally advanced technology systems; the competitive environment; economic business and political conditions domestically and internationally; programme performance and the timing of contract payments; the timing and customer acceptance of product deliveries and launches; our ability to achieve or realise savings for our customers or ourselves through our global cost-cutting programme and other financial management programmes; and the outcome of contingencies (including completion of any acquisitions and divestitures, litigation and environmental remediation efforts).

These are only some of the numerous factors that may affect the forward-looking statements contained in this document.

The Company undertakes no obligation to revise or update forward-looking statements as a result of new information since these statements may no longer be accurate or timely.