Rome, 11 March 2025 14:56 Inside Information

RESULTS FY2024

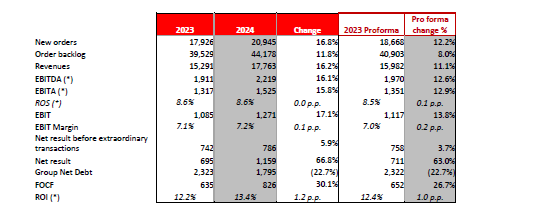

- New Orders increased to €20.9 billion (+12.2%1 compared to Pro-forma 2023), with a book-to-bill ratio of 1.2x

- Revenues increased to €17.8 billion (+11.1%1 vs Pro-forma 2023)

- EBITA2 increased to €1,525 million (+12.9%1 vs Pro-forma 2023)

- Net Result before extraordinary transactions, amounting to €mil. 786 (+3.7%1 vs Pro-forma 2023), benefitted from the improvement of EBIT

- Net Resultof oh €mil. 1,159 (+63.0%1 vs Pro-forma 2023) included, in addition to the Net Result before extraordinary transactions, the capital gain (€mil. 366) recognised after the fair value measurement of the Telespazio Group

- Free Operating Cash Flow higher at €826 million (+26.7%1 vs Pro-forma 2023)

- Group's Net Debt decreased by 22.7%1 to €1,795 million, compared to €2,323 million in 2023

2025 GUIDANCE

Based on the current assessments of the impacts of the geopolitical situation also on supply chain, inflationary levels and the global economy, subject to any further significant effects

- Order of ca. € 21 billion

- Revenues of ca. € 18.6 billion

- EBITA ca. € 1,660 million

- Free Operating Cash Flow of ca. € 870 million

- Group Net Debt of ca. € 1.6 billion

1 In order to make the Group’s performance more comparable, the comparative data for the financial year is also provided in Proforma version, including the contribution of the Telespazio Group, fully consolidated starting from January 1, 2024.

2 To provide an integrated view of Leonardo’s performance in the sectors in which it operates, starting from this financial year, the Group has revised the composition of EBITA to standardize the treatment of economic results from strategic affiliates with that of fully consolidated companies. Specifically, from the share of the net result of strategic affiliates, already included within the Group’s EBITA under the equity method of valuation, non-recurring, exceptional, or non-operating economic items are now excluded. This adjustment, in line with Leonardo’s policies and the approach already applied to fully consolidated companies, ensures that EBITA reflects a profitability that is not affected by volatile elements.

-----------------------------------------------------------------------------------

The Board of Directors of Leonardo, convened today under the Chairmanship of Stefano Pontecorvo, examined and unanimously approved the full year 2024 results.

FY 2024 Results

The financial performance for the 2024 fiscal year confirms the Group’s strong performance, with growth in volumes, solid profitability, and positive cash generation.

Orders reached €20.9 billion, representing a 16.8% increase compared to 2023 (+12.2% compared to Pro-forma data), even in the absence of major large contracts. This growth was driven by the contribution from Electronics for Defense and Security, which spanned all key business areas of the EDS Europe segment and the subsidiary Leonardo DRS, as well as the Helicopters division, both in the government and commercial sectors. The contribution from Cyber & Security Solutions, along with growth across all business sectors in which the Group operates, also contributed to the increase.

The Order Backlog ensures a coverage in terms of equivalent production equal to 2.5 years, and exceeded the threshold of €bil. 44 in 2024, thanks to the success of the commercial campaigns carried out in the last years.

Revenues grew by 16.2% to €17.8 billion (+11.1% compared to Pro-forma data), with nearly all business sectors seeing growth, particularly driven by the consistent improvement in the execution capacity of the order book and the ongoing optimization of the supply chain. Notably, the Electronics for Defense and Security segment, both in Europe and especially the U.S., and the Helicopters division, played a significant role in this growth.

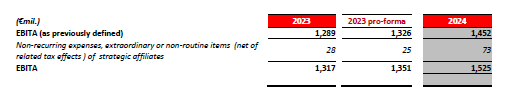

EBITA amounted to €1,525 million, reflecting the strong performance of the Group’s businesses, with a 15.8% increase compared to 2023 (+12.9% compared to Pro-forma data), primarily driven by higher activity volumes. The solid performance in the Defence & Security business segment, particularly Electronics, and the acceleration of the savings plan, more than offset the effect of some negative external factors on both the Aerostructures performance and the Space manufacturing segment. The indicator, as defined above, equal to €mil. 1,452 (€mil. 1,326 in the Pro-forma figure of 2023), was in line with the set targets and was up from the previous year, thus confirming the positive impact of the actions envisaged in the business plan and despite the mentioned challenges.

To provide an integrated view of Leonardo’s performance in the sectors in which it operates, starting from this financial year, the Group has revised the composition of EBITA to standardize the treatment of economic results from strategic affiliates with that of fully consolidated companies. Specifically, from the share of the net result of strategic affiliates, already included within the Group’s EBITA under the equity method of valuation, non-recurring, exceptional, or non-operating economic items are now excluded. This adjustment, in line with Leonardo’s policies and the approach already applied to fully consolidated companies, ensures that EBITA reflects a profitability that is not affected by volatile elements.

The Net Result before extraordinary transactions, amounting to €mil. 786 (€mil. 758 in the Pro‐forma figure of the comparative period), benefitted from the improvement of EBIT and from lower net finance costs, partially offset by the higher taxation for the period.

The Net Result of €mil. 1,159 (€mil. 711 in the Pro‐forma figure of the comparative period) included, in addition to the Net Result before extraordinary transactions, the capital gain (€mil. 366) recognised after the fair value measurement of the Telespazio Group, carried out for the purposes of its consolidation on a line‐ by‐line basis.

The Free Operating Cash Flow, amounting to €mil. 826, up by 30.1% compared to the 2023 figure of €mil. 635 (€mil. 652 in the Pro-forma figure) and in line with expectations, confirmed the positive trend that had already been highlighted in previous years. The results achieved benefitted from the actions aimed at strengthening the business performance, and the good cash-ins process, a tighter control on investments while supporting business growth and an effective financial strategy.

The Group Net Debt, equal to €mil. 1,795, showed an improvement (22.7%) compared to 31 December 2023 (€mil. 2,323); the figure benefitted from strengthening the cash generation of the Group and from postponements in the “bolt-on” acquisition plan.

Key Performance Indicators

(*) 2023 Restated figure as a result of the revision of KPIs.

The Group’s business conducted through JVs and associates with strategic and financial importance (including GIE‐ATR, MBDA, Hensoldt and Thales Alenia Space) is only reflected at the level of profitability ratios (EBITDA, EBITA, EBIT and Net Result) as a result of the valuation at equity and, from a financial point of view7, limited to the dividends collected. In 2024 the Group strategic JVs and associates recorded total revenues of €bil. 3.0 (€bil. 2.8, of the Pro‐forma figure in 2023), as concerns Leonardo’s share: as a result, the Group’s aggregate revenues would come to about €bil. 20.8 (€bil. 18.8 of the Pro‐forma figure in 2023).

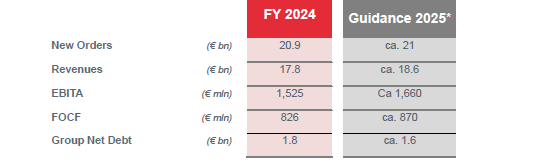

2025 GUIDANCE

In line with challenges Leonardo Group faces, 2025 expectations confirm the sustainable growth path initiated in the 2024-2028 Industrial Plan, with the gradual strengthening of its competitive positioning in both domestic and international markets supported by increased profitability and cash generation. Based on the current assessments of the impacts of the geopolitical situation also on supply chain, inflationary levels and the global economy, subject to any further significant effects, Leonardo expects for 2025:

- Level of new orders at around €21 billion, in line with the good performance recorded in 2024. For 2025, further strengthening of the "core business" is expected, driven by the growth of orders in Defence and Security Electronics and Helicopters and on proprietary Aircraft platforms, confirming the commercial successes and good positioning of the Group's products, technologies and solutions and the ability to effectively cover key markets.

- Revenues of approximately €18.6 billion, up compared to 2024 thanks to the contribution of activities already in the order backlog, which in 2024 reached a record value of approximately €44 billion, also thanks to the gradual overcoming of the difficulties encountered in the supply chain as well as new orders.

- increasing profitability, with EBITA of approximately € 1,660 million, supported by volume growth and the confirmation of strong levels of industrial profitability in the main business areas. The forecast also reflects the impact and progressive recovery of the Aerostructures business following the increase in deliveries requested by Boeing.

- FOCF of ca € 870 million, with the defense and government business providing solid cash generation and more than offsetting the gradually improving cash absorption in Aerostructures

- Group net debt of approximately €1.6 billion, decreasing thanks to the increase in cash generation, proceeds from the sale of the UAS business, and after the payment of dividends of €0.52 per share, M&A transaction of ca. €500 million, DRS shareholders remuneration, new leasing contracts and other minor movements.

Below is the summary table:

(*) Assuming an exchange rate of €/USD a 1.08 €/GBP a 0.86

Based on the current assessments of the impacts of the geopolitical situation also on supply chain, inflationary levels and the global economy, subject to any further significant effects

Commercial and business performance

New orders reached €bil. 20.9, showing a considerable growth compared to 2023 (+16.8%, +12.2% compared to the Pro-forma figure), albeit a lack of large orders, thanks to the major contribution given by Defence Electronics & Security, in all the main business areas of the European DES component and in that of the subsidiary Leonardo DRS, as well as of Helicopters, in the government and commercial fields. We also note an increase in the contribution given by Cyber & Security Solutions, and, in general, by all the business sectors in which the Group operates. The trend in New orders highlights the effectiveness of the Leonardo Group's commercial offer and the strengthening of its international footprint on an ongoing basis, in a context characterised by growing demand for defence and security products and solutions. The level of New orders corresponds to a book-to-bill (ratio of New orders to Revenues for the period) equal to about 1.2. The Order Backlog ensures a coverage in terms of equivalent production equal to 2.5 years, and exceeded the threshold of €bil. 44 in 2024, thanks to the success of the commercial campaigns carried out in the last years.

Revenues (€bil. 17.8, €bil. 16.0 in the Pro-forma figure of comparative period) showed a significant increase compared to 2023 (+16.2%, +11.1% against Pro-forma data) in almost all business areas, particularly driven by the consistent improvement in the execution capacity of the order book and the ongoing optimization of the supply chain. Particularly significant is the contribution given by the Defence Electronics & Security in its European component, but particularly in the U.S., and by Helicopters.

EBITA (€mil. 1,525, €mil. 1,351 in the Pro-forma figure of comparative period) reflected the sound performance of the Group’s businesses, showing a sharp rise compared to 2023 (+15.8%, +12.9% in the Pro-forma figure), mainly as a result of an increase in business volumes. The solid performance in the Defence & Security business segment, particularly Electronics, and the acceleration of the savings plan, more than offset the effect of some negative external factors on both the Aerostructures performance and the Space manufacturing segment. The indicator, as defined above, equal to €mil. 1,452 (€mil. 1,326 in the Pro-forma figure of 2023), was in line with the set targets and was up from the previous year, thus confirming the positive impact of the actions envisaged in the business plan and despite the aforementioned challenges.

Likewise, EBIT, equal to €mil. 1,271, recorded an increase (+17.1%, +13.8% in the Pro‐forma figure of the comparative period) despite being affected by higher non‐recurring one‐off charges, mainly due to the effects deriving from the successful termination and settlement of contracts and projects related to previous years. Additionally, EBIT was also affected by the amortisation of the Purchase Price Allocation connected, inter alia, with the first‐time consolidation of the Telespazio Group, which took place from 1 January 2024; the latter effects were partially offset by lower restructuring costs compared to the comparative period.

The Net Result before extraordinary transactions, amounting to €mil. 786 (€mil. 758 in the Pro‐forma figure of the comparative period), benefitted from the improvement of EBIT and from lower net finance costs, partially offset by the higher taxation for the period.

The Net Result of €mil. 1,159 (€mil. 711 in the Pro‐forma figure of the comparative period) included, in addition to the Net Result before extraordinary transactions, the capital gain (€mil. 366) recognised after the fair value measurement of the Telespazio Group, carried out for the purposes of its consolidation on a line‐ by‐line basis.

Financial performance

The FOCF, amounting to €mil. 826, up by 30.1% compared to the 2023 figure of €mil. 635 (€mil. 652 in the Pro-forma figure) and in line with expectations, confirmed the positive trend that had already been highlighted in previous years. The results achieved benefitted from the actions aimed at strengthening the business performance, and the good cash-ins process, a tighter control on investments while supporting business growth and an effective financial strategy.

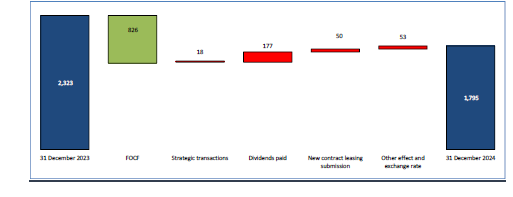

The Group Net Debt, equal to €mil. 1,795, showed an improvement (22.7%) compared to 31 December 2023 (€mil. 2,323); the figure benefitted from strengthening the cash generation of the Group and from postponements in the “bolt-on” acquisition plan.

The figure also includes the financial effects of the transactions that are described below:

- the dividend that was paid in July for €mil. 177 (of which €mil. 161 relating to Leonardo S.p.a.). It should be noted that the dividend paid by Leonardo S.p.a. doubled from the 2023 value, (€0.28 per share compared to €0.14 per share in 2023), in line with what was announced in the 2024-2028 Business Industrial Plan;

- the execution of new lease agreements for €mil. 50;

- the acquisition, which was completed in September 2024, concerning an additional 35% of GEM Elettronica S.r.l., for a consideration equal to about €mil. 16;

- the translation of foreign currency positions and other items.

Changes in Group Net Debt

As at 31 December 2024, Leonardo S.p.A. had sources of liquidity available for a total of about €mil. 3,620 to meet the financing needs of the Group’s recurring operations, broken down as follows:

- an ESG-linked Revolving Credit Facility for an amount of €mil. 1,800, expiring on 7 October 2026, initially equal to €mil. 2,400 and divided into two tranches, the first of which, equal to €mil. 600, expired on 7 October 2024;

- additional unconfirmed short-term lines of credit of about €mil. 820;

- a framework programme for the issue of commercial papers on the European market (Multi-Currency Commercial Paper Programme) for a maximum amount of €bil. 1 expiring on 2 August 2025.

The Company also has a €mil. 260 Sustainability-linked financing granted by the European Investment Bank (EIB) – with a contract signed in November 2022 – entirely unused at the date of this report.

Furthermore, Leonardo has unconfirmed lines of credit for a total of €mil. 11,419, of which €mil. 3,451, still available as at 31 December 2024.

Finally, other Group subsidiaries have the following credit facilities:

- Leonardo DRS has a Revolving Credit Facility for an amount of USDmil. 275 (€mil. 265), entirely unused at 31 December 2024;

- Leonardo US Corporation has short-term revocable credit lines, guaranteed by Leonardo S.p.a., for USDmil. 210 (€mil. 202), which were unused at 31 December 2024;

- Leonardo US Holding has short-term revocable credit lines, guaranteed by Leonardo S.p.a., for USDmil. 5 (€mil. 5), which were unused at 31 December 2024.