Rome, 07 November 2024 16:56

- Backlog at record level > € 43 billion with a book to bill at 1,2x

- Effective delivery of backlog, especially across in Electronics and Helicopters

- EBITA improvement driven by growing volumes, mainly in Electronics

- Continuous improvement of FOCF

- Group Net Debt at € 3.1 billion (-19%1)

- Establishingof the JV with Rheinmetall strengthens the positioning in the international context

- Net Results at € 730 mln, including a one-off benefit of € 366 million for the fair value measurement of the Telespazio Group

* – vs 9M23 pro-forma

Leonardo's Board of Directors, convened today under the Chairmanship of Stefano Pontecorvo, examined and unanimously approved the 2024 first nine months results.

“The economic-financial performance of the period, together with the development of the business and the strengthening of the financial indicators, plus the implementation of the existing efficiency program, is all confirming the validity of the path undertaken in pursuing the objectives indicated in the Industrial Plan.” – Roberto Cingolani, Leonardo CEO and GM, stated.

“The consolidation and strengthening of our core defense business is proceeding in line with the objectives we have set thanks to the acceleration of the digitalisation process and the rationalization of the portfolio. After the creation of the new Space Division, aimed at positioning in new business segments with higher added value, the sale of Underwater Armaments & Systems to Fincantieri, and the exit from non-core businesses such as Industria Italiana Autobus and Skydweller, Leonardo has finalized the acquisition, in the radar sector, of control of GEM Elettronica. The path of international alliances has seen the establishment of the Joint Venture with Rheinmetall, which allows the company to play a key international role in the programs of the new Main Battle Tank (MBT) and the new Lynx platform for the Armored Infantry program Combat System (AICS). This achievement, achieved in less than six months, demonstrates the strategic importance of moving with agility and determination in the international competitive scenario. We have defined, together with our customers and partners, the main elements of the GCAP program which will become definitive with the formal signing of an industrial agreement by the end of the year. These elements provide strategic activities in the development of systems of systems for Leonardo. The evaluation of growth and development opportunities in the cyber and space sector also continues”. Roberto Cingolani, Leonardo CEO and GM, concluded.

9M 2024 financial results

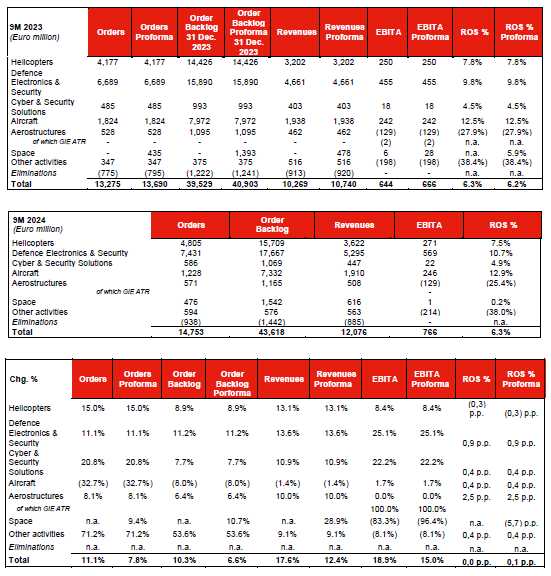

In order to make the Group's operating performance more comparable, the indicators for the comparative period are also provided on a pro-forma basis, including the contribution of the Telespazio group, consolidated on a line-by-line basis starting from 1 January 2024.

In the first nine months of 2024, New Orders and Revenues increased by 11.1% (+7.8% compared to the pro-forma figure of September 2023) and by 17.6% (+12.4% compared to the pro-forma figure) respectively, driven in particular by the Defence Electronics & Security and Helicopters businesses. The growth of Revenues was accompanied by an increase in EBITA of 18.9% (+15.0% compared to the pro-forma figure), with a ROS for the period equal to 6.3% (in line with that at 30 September 2023, increasing compared to the pro-forma figure, equal to 6.2%).

Free Operating Cash Flow for the period also improved (+8.9%, +13.7% compared to the pro-forma figure), whose performance, together with the sale of the minority stake in Leonardo DRS, which occurred in the last quarter of 2023, resulted in a consequent positive impact on the Group's net debt, which decreased by 18.2% compared to the comparative period (19.0% compared to the pro-forma figure).

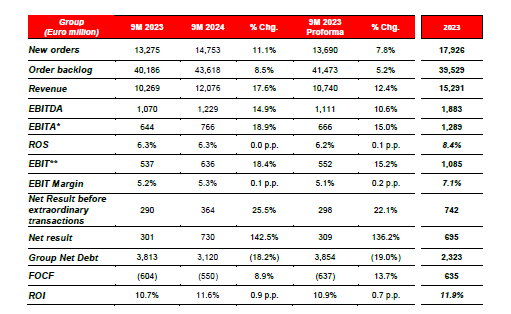

Key Performance Indicators

The Key Performance Indicators for the comparative period are provided also on a pro-forma basis, including the effects of the line-by-line consolidation of Telespazio:

*’EBITA is obtained by eliminating from EBIT the following items: any impairment in goodwill; amortisation and impairment, if any, of the portion of the purchase price allocated to intangible assets as part of business combinations; restructuring costs that are a part of defined and significant plans; other exceptional costs or income, i.e. connected to particularly significant events that are not related to the ordinary performance of the business.

**EBIT is obtained by adding to Income before tax and financial expenses (the Group’s share of profit in the results of its strategic investments (ATR, MBDA, Thales Alenia Space and Hensoldt), reported in the “share of profits (losses) of equity-accounted investees”

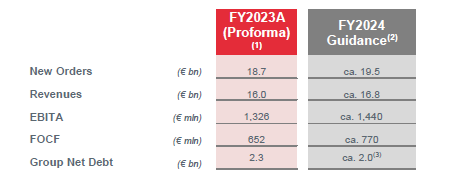

2024 Guidance

In view of the results achieved in the first nine months of 2024 and the expectations for the coming periods, we confirm the guidance for the full year 2024 as disclosed in March 2024.

Below is the summary table:

Exchange rate assumptions: € / USD = 1.15 and € / GBP = 0.89

1) The values shown for the year 2023 enhance the full consolidation of Telespazio, effective from 2024

2) Based on the current assessment of the effects deriving from the geopolitical situation on the supply chain and the global economy and assuming no additional major deterioration.

3) Assuming the increased dividend payment from € 0.14 to € 0.28 per share, new leasing contracts, strategic investments, and other minor transactions.

Commercial Performance

- New Orders, amounted to EUR 14,753 million significantly increasing (+11.1%, +7.8% on the pro-forma figure) compared to the first nine months of 2023, with a particular positive performance of the Defence Electronics and Security (DES) business, both of the European DES component and of the subsidiary Leonardo DRS, as well as of Helicopters in the government and commercial fields. We also note an increase in the Cyber & Security Solutions and Aerostructures. The level of New orders is equal to a book to bill (the ratio of New orders to Revenues for the period) of about 1.2

- Backlog, amounted to EUR 43,618 million ensures a coverage in terms of production exceeding 2.5 years

Economic Performance

- Revenues, amounted to EUR 12,076 million, increased compared to the first nine months of 2023 (+17.6%, +12.4% on the pro-forma figure) in almost all business sectors, with a significant contribution from the Defence Electronics and Security and Helicopters sectors

- EBITA, amounted to EUR 766 million, reflected the solid performance of the Group’s businesses, showing an increase compared to the first nine months of 2023 (+18.9%, +15.0% on the pro-forma figure), mainly as a result of the increase in the activity volumes. The period was particularly affected by the performance of the Defence Electronics and Security, sharply improving compared to the same period of the prior year, while the Space sector was affected by the expected difficulties in the manufacturing segment

- EBIT, amounted to EUR 636 million, reported a growth (+18.4%, +15.2% on the pro-forma figure) despite being affected by an increase in non-recurring one-off charges, mainly due to the effects deriving from the positive termination and settlement of contracts entered into in previous years. Additionally, EBIT was also affected by the amortisation of the Purchase Price Allocation connected with the first-time consolidation of the Telespazio group starting from 1 January 2024. The above-said charges were partially offset by lower restructuring costs compared to the comparative period

- Net Result before extraordinary transactions, amounted to EUR 364 million, (€mil. 290 in the comparative period, €mil. 298 on the pro-forma figure), benefitted from the improvement of EBIT and from lower finance costs, partially offset by the higher taxation for the period

- Net Result, equal to EUR 730 million (€mil. 301 in the comparative period, €mil. 309 on the pro-forma figure) included, in addition to the Net Result before extraordinary transactions, the capital gain (€mil. 366) recognised after the fair value measurement of the Telespazio group, carried out for the purposes of its line-by-line consolidation

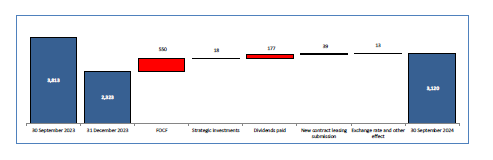

Financial performance

- Free Operating Cash Flow (FOCF), negative for EUR 550 million, improving compared to the performance at 30 September 2023 (negative for €mil. 604, negative for €mil. 637 in the pro-forma figure), confirmed the positive results reached thanks to initiatives to strengthen the operational performance and the collection cycle, a careful investment policy in a period of business growth and an efficient financial strategy. The figure however highlighted the usual interim trend that is characterised by significant cash absorptions during the first part of the year

- Group Net Debt, of EUR 3,120 million, reduced significantly (about €bil. 0.7) against September 2023, thanks to the strengthening of the Group's cash generation and to the sale of the minority stake in Leonardo DRS, occurred in the last quarter of 2023. Compared to 31 December 2023 (€mil. 2,323) the value increased mainly as a result of the FOCF performance, in addition to the payment of dividends for an amount equal to €mil. 177 (of which €mil. 160 relating to Leonardo S.p.a.) and to the signing of new lease agreements in the period, for a value of €mil. 39

SECTOR PERFORMANCE

The Key Performance Indicators of the business Sectors are reported below while pointing out that – starting from 1 January 2024 - the contribution from the line-by-line basis consolidation of the Telespazio group is included in the Space sector. Furthermore, with the purpose of providing a representation mode increasingly in line with the Group’s corporate strategies and the underlying business trends, the Defence Electronics & Security and Cyber & Security Solutions sectors, which were aggregated until the 2023 Financial Statements within the Defence Electronics & Security only. The Sectors’ performance will be therefore represented and commented on with reference to the following operating sectors: Helicopters, Defence Electronics & Security, Cyber & Security Solutions, Aircraft, Aerostructures and Space (Helicopters, Defence Electronics & Security, Aircraft, Aerostructures and Space in the 2023 financial statements).

In order to make operating performance comparable, the indicators for the comparative period have been restated in this section for ease of comparison. With reference to the Space sector, the comparative period is presented on a pro-forma basis, including the contribution of the Telespazio group.

Leonardo continued the path to growth in all sectors of its core business. The trend of New orders, revenues and EBITA by sector was as follows: