Rome, 20 February 2025 16:04

Results above or in line with 2024 Guidance

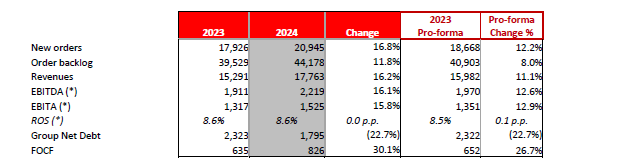

- New Orders increased to €20.9 billion (+12.2%1 compared to Pro-forma 2023), with a book-to-bill ratio of 1.2x

- Revenues increased to €17.8 billion (+11.1%1 vs Pro-forma 2023)

- EBITA2 increased to €1,525 million (+12.9%1 vs Pro-forma 2023)

- Free Operating Cash Flow higher at €826 million (+26.7%1 vs Pro-forma 2023)

The Group's Net Debt decreased by 22.7%1 to €1,795 million, compared to €2,322 million in 2023

Sustainability KPIs improved across all areas: social, innovation, and environment

Update on the Industrial Plan will be presented on March 11

1 In order to make the Group’s performance more comparable, the comparative data for the financial year is also provided in Proforma version, including the contribution of the Telespazio Group, fully consolidated starting from January 1, 2024.

2 To provide an integrated view of Leonardo’s performance in the sectors in which it operates, starting from this financial year, the Group has revised the composition of EBITA to standardize the treatment of economic results from strategic affiliates with that of fully consolidated companies. Specifically, from the share of the net result of strategic affiliates, already included within the Group’s EBITA under the equity method of valuation, non-recurring, exceptional, or non-operating economic items are now excluded. This adjustment, in line with Leonardo’s policies and the approach already applied to fully consolidated companies, ensures that EBITA reflects a profitability that is not affected by volatile elements.

-----------------------------------------------------------------------------------

The Board of Directors of Leonardo reviewed today the preliminary results for the year ended December 2024.

“The 2024 preliminary results,” said Roberto Cingolani, CEO and General Manager of Leonardo, “demonstrates the economic, financial, and industrial strength of Leonardo, with a medium-term development outlook aligned with the objectives outlined in the Industrial Plan. In 2024, we experienced significant volume growth alongside improved EBITA. The strong performance of the Defense and Security segment, coupled with acceleration of the savings plan, offset the impact of external factors in the Aerostructures and Space manufacturing segments. The improvement in Free Operating Cash Flow enables us to reduce the Group’s net debt, while paying a doubled dividend”.

“All of this,” added Roberto Cingolani, “enables Leonardo to increasingly play a leading role in the global Aerospace, Defense, and Security industry, with a growing ability to catalyze new alliances and establish a presence in strategically significant global programs”.

“The past year,” he concluded, “has also been significant in our progress in the field of sustainability. Leonardo is increasingly proving itself to be a company capable of attracting young talent, being inclusive, driving innovation, and improving its environmental impact. This is a substantial commitment that involves the entire company and its partners”.

2024 Preliminary Results

The financial performance for the 2024 fiscal year confirms the Group’s strong performance, with growth in volumes, solid profitability, and positive cash generation.

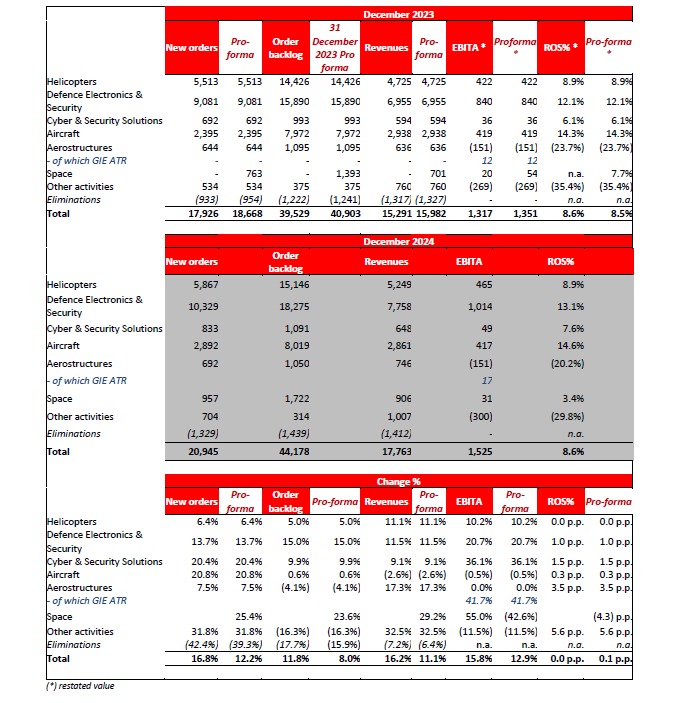

Orders reached €20.9 billion, representing a 16.8% increase compared to 2023 (+12.2% compared to Pro-forma data), even in the absence of major large contracts. This growth was driven by the contribution from Electronics for Defense and Security, which spanned all key business areas of the EDS Europe segment and the subsidiary Leonardo DRS, as well as the Helicopters division, both in the government and commercial sectors. The contribution from Cyber & Security Solutions, along with growth across all business sectors in which the Group operates, also contributed to the increase.

The Order Backlog ensures a coverage in terms of equivalent production equal to 2.5 years, and exceeded the threshold of €bil. 44 in 2024, thanks to the success of the commercial campaigns carried out in the last years.

Revenues grew by 16.2% to €17.8 billion (+11.1% compared to Pro-forma data), with nearly all business sectors seeing growth, particularly driven by the consistent improvement in the execution capacity of the order book and the ongoing optimization of the supply chain. Notably, the Electronics for Defense and Security segment, both in Europe and especially the U.S., and the Helicopters division, played a significant role in this growth.

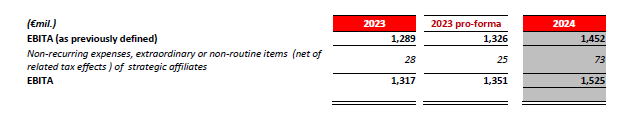

EBITA amounted to €1,525 million, reflecting the strong performance of the Group’s businesses, with a 15.8% increase compared to 2023 (+12.9% compared to Pro-forma data), primarily driven by higher activity volumes. The solid performance in the Defence & Security business segment, particularly Electronics, and the acceleration of the savings plan, more than offset the effect of some negative external factors on both the Aerostructures performance and the Space manufacturing segment. The indicator, as defined above, equal to €mil. 1,452 (€mil. 1,326 in the Pro-forma figure of 2023), was in line with the set targets and was up from the previous year, thus confirming the positive impact of the actions envisaged in the business plan and despite the mentioned challenges.

To provide an integrated view of Leonardo’s performance in the sectors in which it operates, starting from this financial year, the Group has revised the composition of EBITA to standardize the treatment of economic results from strategic affiliates with that of fully consolidated companies. Specifically, from the share of the net result of strategic affiliates, already included within the Group’s EBITA under the equity method of valuation, non-recurring, exceptional, or non-operating economic items are now excluded. This adjustment, in line with Leonardo’s policies and the approach already applied to fully consolidated companies, ensures that EBITA reflects a profitability that is not affected by volatile elements.

The Free Operating Cash Flow, amounting to €mil. 826, up by 30.1% compared to the 2023 figure of €mil. 635 (€mil. 652 in the Pro-forma figure) and in line with expectations, confirmed the positive trend that had already been highlighted in previous years. The results achieved benefitted from the actions aimed at strengthening the business performance, and the good cash-ins process, a tighter control on investments while supporting business growth and an effective financial strategy.

The Group Net Debt, equal to €mil. 1,795, showed an improvement (22.7%) compared to 31 December 2023 (€mil. 2,323); the figure benefitted from strengthening the cash generation of the Group and from postponements in the “bolt-on” acquisition plan.

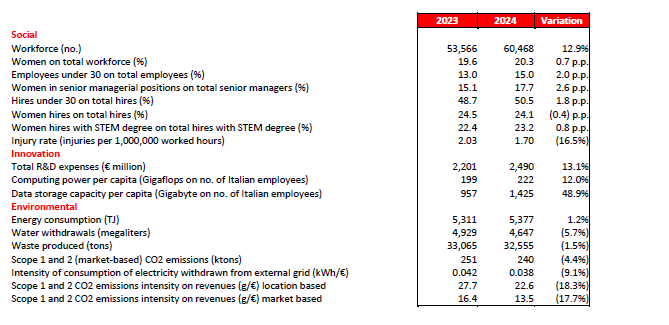

In 2024, the sustainability performance indicators in the social, innovation, and environmental areas are improving.

In 2024, the workforce increased by 6,902 employees compared to 2023 (+12.6%), which was also due to the consolidation of Telespazio, with employees under 30 representing 15.0% of the total (+2.0 percentage points compared to 2023), continuing the positive trend of recent years. The share of new hires under 30 as a percentage of total hires also rose by +1.8 percentage points versus 2023, reflecting the ongoing development of skills within the Group. The commitment to creating an environment which enhances gender equality is demonstrated by the increase in the number of female executives who achieved 17.7% of total managers, and by the new female hires with STEM degrees, the ratio of which to total hires of workers with STEM degrees increased compared to 2023 (+0.8 p.p.), standing at 23.2%.

Following investments made in 2024, computing power and storage capacity per employee increased (+12.0% and +48.9%, respectively, compared to 2023). Research and development spending reached €2.490 billion (+13.1%), accounting for approximately 14% of revenues.

Despite the growth in business and revenues compared to 2023, there was a further reduction in emission intensities Scope 1 and 2 (-18.3% location-based and -17.7% market-based), thanks to, mainly, the increased share of renewable energy purchased from the grid, a substantial reduction in emission factors in certain countries where Leonardo operates, and improvements in energy efficiency and thermal plant operations.

Several important milestones were achieved, in the sustainability area, throughout the year, including the validation of decarbonization targets by the Science Based Targets initiative, including downstream and upstream Scope 3 emissions, and the UNI/PdR125:2022 certification for gender equality. Finally, in 2024, Leonardo was confirmed for the fifteenth consecutive year in the Dow Jones Sustainability Indices (DJSI World and DJSI Europe).

Key Performance Indicators

(*) As from the current year, Leonardo has revised the composition of these KPIs with regard to the results of those investees that are regarded as being strategic, excluding the effects arising from the volatility originated by non-recurring, extraordinary or non-routine items in the income statement, in line with the approach already applied to companies consolidated on a line-by-line basis. Following the new definition, comparative data are provided in restated form.

The Group’s business conducted through JVs and associates with strategic and financial importance (including GIE-ATR, MBDA, Hensoldt and Thales Alenia Space) is only reflected at the level of EBITA, as a result of the valuation at equity and, from a financial point of view, limited to the dividends collected. In 2024 the Group strategic JVs and associates recorded total revenues of €bil. 3.0 (€bil. 2.8 in 2023, Pro-forma figure), as concerns Leonardo’s share: as a result, the Group’s aggregate pro-forma revenues would come to about €bil. 20.8 (€bil. 18.8 in 2023, Pro-forma figure).

Sustainabilility and Performance indicators

PERFORMANCE BY SECTOR